ATO provides further clarity on DIN process

The ATO and the SMSF Association have clarified some of the areas of confusion with respect to the director identification number process and outlined some of the ATO’s longer-term plans.

The ATO and the SMSF Association have clarified some of the areas of confusion with respect to the director identification number process and outlined some of the ATO’s longer-term plans.

Imagine this scenario: George, who lives in Melbourne and is aged 23, gets a call from his grandmother in Athens. Grandma says she is going to give him $100,000 for Christmas. George is ecstatic. With profuse thankfulness, George gives Grandma the bank details.

The following links are to the latest state and federal government plans, schemes, programs, and initiatives to help businesses and individuals manage the impact of yet more COVID-19 restrictions.

The growth trajectory of more Millennial SMSFs is set to continue in the years to come, according to the chief executive of Smarter SMSF.

As we fly into our second pandemic-impacted festive season, many employers are now, more than ever, looking to bring a little bit of cheer to their employees.

With the recent pandemic, there have been more conversations and questions over the role of the employer in supporting the wellbeing of their employees.

The following are some of the links to information on a number of State and Federal initiatives that might help your business through these tough times.

The ATO says it will be focusing on accessing new third-party data, automating audit processes, increasing its access to high-quality data and preventative strategies in order to drive down the overall tax gap.

Come back each day and click on the next date for another inspirational quote or poem from some of the greatest writers and poets.

Modern business demands up to date accurate financial information.

We can take care of all your bookkeeping and accounting needs, including the preparation of your annual accounts and periodic management accounts for tax, business appraisal and planning purposes.

We can also assist with meeting your reporting requirements including Business Activity Statements, PAYG Withholding and Instalment Activity Statements.

We will discuss your requirements with you and provide you with tailored information and constructive advice on a regular basis.

If you would like further information you can contact us on (02) 9300 3000 or .

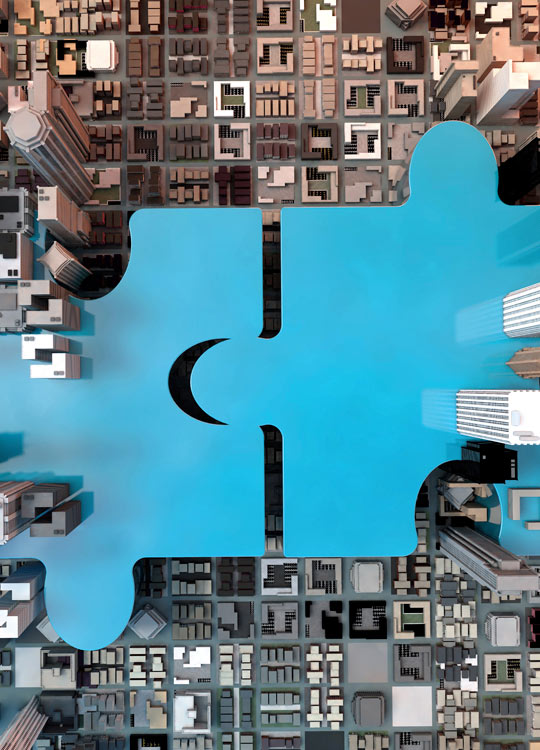

Whether you are considering buying or selling a business, we are able to assist you in this transaction by providing experienced advice.

Each transaction is different and needs to be assessed on its individual merits. There are a number of accounting and taxation opportunities with these transactions and our experience can ensure you are maximising your benefits.

If you would like further information you can contact us on (02) 9300 3000 or .

A good budget is a necessity in a good business plan. It is one of the best business tools we have, allowing us to set financial targets and measure our performance.

In addition to goal setting value, budgets will often improve your chances of acquiring funding. Financers often require budgets as a prerequisite for funding approval.

We have extensive experience with assisting clients in the budgeting process.

If you would like further information you can contact us on (02) 9300 3000 or .

Before commencing a new business, the following are some of the key items that need to be considered:

Each new business is different and needs to be considered in relation to your individual circumstances and our experience can ensure you are maximising your opportunities.

If you would like further information you can contact us on (02) 9300 3000 or .

Charitable institutions are set up to hold money or assets and carry out activities for the benefit of the community. In Australia, a variety of charitable institutions exist including:

Each type of charitable institution brings with it different requirements and benefits. We know the practicalities of these institutions and are able to assist you by:

If you would like further information you can contact us on (02) 9300 3000 or .

Company legislation requires businesses to perform many administration tasks which take up a lot of valuable company time.

We are able to assist you in the following areas:

If you would like further information you can contact us on (02) 9300 3000 or .

Having the right financial structure in place for your business or your family means looking at your individual circumstances and ensuring that your assets are being maximised whilst being adequately protected.

We have extensive experience in ensuring our clients have the best financial structure for their needs both now and in the future. We can provide advice on and assist with:

If you would like further information you can contact us on (02) 9300 3000 or .

Every transaction has GST implications. We have experience with these issues and are able to offer expert advice on the implications of GST for your business. The GST related services we offer include:

If you would like further information you can contact us on (02) 9300 3000 or .

We are practiced in acting as a sounding board for management, bringing to the relationship years of experience in business growth and analysis.

We are able to check that your business is as competitive, focused, and profitable as it can be and we will work with you to address any issues.

If you would like further information you can contact us on (02) 9300 3000 or .

We can provide a comprehensive and confidential payroll service including:

If you would like further information you can contact us on (02) 9300 3000 or .

We can assist in a variety of areas in relation to residential and commercial property including:

If you would like further information you can contact us on (02) 9300 3000 or .

Clients of Wybenga & Partners Pty Limited can engage our partner firm, Washington Brown, for a competitive price on their depreciation services: Tax Depreciation Quote Request – Wybenga & Partners Pty Limited Clients

Our Strategic Planning Service is designed to assist our clients to develop financially towards the achievement of their lifetime objectives. Our experience and proven results provide our clients with the security that their financial goals will be met.

Wybenga Financial Pty Ltd is an organisation providing wealth creation and management services to private clients.

If you would like further information you can contact us on (02) 9300 3000 or .

Self-managed superannuation is a flexible means of saving for retirement. It allows you to take control of your superannuation, adopt a customized investment strategy and control fund administration costs.

Superannution law is a delicate area and personalised planning is required for each individual. We have extensive experience in all areas relating to superannuation and can assist in establishing a superannuation fund that will effectively allow you to reach your financial retirement goals.

Services we offer include:

If you would like further information you can contact us on (02) 9300 3000 or .

We offer a complete range of taxation services and advice based on proven knowledge and experience. Our proactive approach ensures we deliver a consistent service and build solid relationships.

We will work with you to help reduce your tax exposure and provide services including:

If you would like further information you can contact us on (02) 9300 3000 or .

A trust provides a valuable way of protecting the assets you have accumulated for the benefit of yourself and others. A trust can also be an effective structure for running your business.

We have extensive experience with trusts and are able to offer specialist advice on establishment and compliance, ensuring that all statutory requirements are met.

Wybenga & Partners are able to organise for the preparation and execution of documentation involved in Trust formation.

Our Trust administration service includes:

If you would like further information you can contact us on (02) 9300 3000 or .

Secure File Transfer is a facility that allows the safe and secure exchange of confidential files or documents between you and us.

Email is very convenient in our business world, there is no doubting that. However email messages and attachments can be intercepted by third parties, putting your privacy and identity at risk if used to send confidential files or documents. Secure File Transfer eliminates this risk.

Login to Secure File Transfer, or contact us if you require a username and password.

Please enjoy the links to these free tools supplied by MoneySmart – a great resource for general financial information. Please get in touch if you would like to discuss any questions that you may have as a result of using these calculators.

Chris is the Managing Director of the Firm who established the practice in August 1994 and has been responsible for its growth and development since that time.

Chris has over 40-years experience in the Chartered Accountancy profession, predominantly spent in small to medium sized firms, advising small and medium sized businesses and individuals in areas such as taxation and accounting as well as business restructuring and superannuation advice.

Chris remains active in the development of young accountants through mentoring cadets at the Firm.

Dianne is responsible for the day-to-day operations and administration of the practice.

Dianne has over 30-years Chartered Accountancy experience and has significant expertise in providing advice and solutions to high-net-worth individuals and their associated entities. Dianne also has considerable knowledge in the areas of taxation, business services, superannuation, and compliance.

Dianne is active in promoting gender equality in the industry through various programs and mentoring opportunities. Dianne is also committed to the development of young accountants and donates considerable time to sharing her expertise.

Roger has over 40-years in the Chartered Accountancy profession and significant expertise in providing advice and solutions to small and medium sized businesses and high-net-worth individuals. He also has extensive experience in the areas of Self-Managed Superannuation Funds and retirement strategies.

Tess has been working in Chartered Accounting Firms since 2021 and in this time has had a broad range of experience in superannuation, taxation, business services and financial strategy.

Since 2016, Tess has turned her attention to Financial Planning, earning a Diploma of Financial Planning in 2015 and leading the financial division of Wybenga Group as a Director of Wybenga Financial.

Tess’s mission is to bring the ethics and integrity of her Chartered Accounting background to the area of wealth management.

As a woman in a male dominated field, Tess is active in promoting gender equality in the industry through various programs and mentoring opportunities.

Using her depth of knowledge and experience in tax and accounting Tess is able to demonstrate a level of competence that is unique in the Financial Planning sector.

Adam has over 18-years experience in Chartered Firms and in this time has had a broad range of experience in superannuation, taxation, and business services. In particular, Adam has had significant experience in MYOB and assisting clients with periodic management reporting.

Adam is responsible for the implementation of technology in the Firm and sourcing new areas of innovation and efficiency.

Adam is active in the development of young accountants and donates considerable time to sharing his expertise.

Hussein brings over 20 years of experience working in Chartered Accounting Firms, during which he has gained extensive expertise in taxation and business services. He provides advice on various tax issues, including capital gains tax, fringe benefits tax, goods and services tax, and Australia’s tax treaties.

Hussein is dedicated to fostering the growth of young accountants and generously devotes a significant amount of time to sharing his knowledge and expertise.

Build your career with expert guidance from our accounting cadetships program, based in Sydney NSW.

Each year we offer several school leavers or undergraduates the opportunity of beginning their career with us via an Accounting Cadetship. If you are interested in pursuing a career in accounting please read the information below. Our accounting cadetships could be perfect for you!

An Accounting Cadetship enables you to commence your career whilst attaining the necessary university qualifications by studying part-time.

Generally, our cadets complete a Bachelor of Commerce (BCom) or Bachelor of Business (BBus) degree at the University of New South Wales, the University of Technology Sydney, Macquarie University, or the University of Western Sydney.

The firm provides 3 hours paid study leave per week to attend University. This can either be taken at the one time or broken between days depending on the individual’s requirements. In addition, the Firm provides paid study leave for both mid-semester and end-of-year exams.

We take the work life balance very seriously at Wybenga & Partners and our cadets are encouraged to have a fulfilling life outside the office. A typical day will have you arriving at the office at around 8.30am with most days concluding at 5.30pm.

Our cadets benefit from the following:

The completion of your degree is the first step of what we hope to be a long and successful career with us. The next step is the commencement of your CA Program with the Institute of Chartered Accountants Australia and New Zealand whilst at the same time continuing your employment with us.

A number of cadets have progressed to Seniors, Managers, and Directors within the firm.

Current Year 12 students or first/second year University Students who:

To apply for a Cadetship position at Wybenga & Partners send us your details. Please also include in your covering letter why you wish to do a cadetship, include relevant qualities you possess, main interests / achievements, and any previous employment.

Interested candidates should initially forward a resume/covering letter of no more than 3-pages. Please provide full details of contact information (telephone or e-mail).

For further information about our Cadetship program, please send your enquiry to .

Wybenga & Partners offers a stimulating work environment giving you the opportunity to develop your future success.

Wybenga & Partners recognises and promotes that there is more to life than work. We know that your needs change and we provide support to balance your work, academic and lifestyle pursuits.

We welcome enquires from trained accountants regarding a career with Wybenga & Partners. Please email us your details to .